Here’s How Much Extra You Will Pay on Gold Jewellery Post GST

With the Goods & Service Tax (GST) slated to be introduced from July 1st across India, all eyes were on the tax slab for Gold, Gold jewellery and Diamond jewellery. The GST Council has earlier announced the rates for most of the other commodities and items, while the GST on gold and few other items were announced on Saturday (Read Economic Times Coverage Here)

Though the industry speculation was for a tax slab of 5% of gold and associated products, the GST council surprised all by introducing a new tax slab for Gold, 3%. This may be the lowest tax percentage for any items under GST. The announcement of GST on gold has brought relief to the customers, the bullion traders and the Gems & Jewellery industry. If you don’t already know, gold was taxed @ 1% across most of the states in the current sales tax regime. This rate varied slightly for some states as Maharashtra, for example, had a VAT rate of 1.2% on gold. Further, the excise department levied an excise duty of 1% on some selected manufacturers and this cost was being passed down to the consumers. That makes the total @ 2%. In comparison to the newly introduced slab under GST where all other state-specific taxes and excise will be eliminated, there will be an increase of 1% on the total cost of jewellery for the consumers.

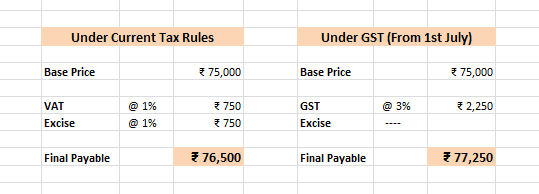

Let’s understand this with the help of an example. If the current base price (without tax) of a piece of jewellery was INR 75000, you ended up paying about INR 76500 for it with 2% Tax. Under the new GST laws, the rate for you would be INR 77250 with 3% GST. That’s a difference of INR 750 on a base price of INR 75000. Similarly, you’d pay INR 1000 extra for every purchase of INR 1 Lacs.

Sample GST Calculation on Gold Jewellery

The above calculation will help you understand the impact of GST on your gold purchases.

GST on Rough Diamonds

Polished diamonds may be the next casualty in the GST regime. The GST Council has applied a tax of 0.25% on rough diamonds, mainly imported into India. The effect of this tax is expected to be indirect for customers as the cost of manufacturing of diamonds will increase leading to increased prices for end produce. Being a premium product, even a slight increase in prices will impact the customers.

Impact for KuberBox Customers

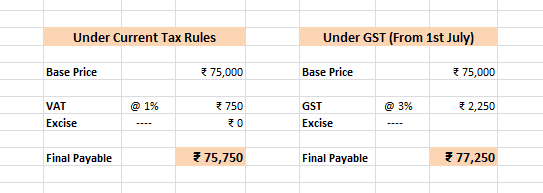

The impact for KuberBox customers will be more severe as we do not pass on the excise component of the tax to our customers. This 1% excise is currently not levied on KuberBox products. Under the GST, we would be required to collect the whole 3% GST from the customers and thus the differential impact will be of 2%.

Old Tax vs GST on Gold for KuberBox Customers

As you can see in the above example, there will be an impact of 2% or INR 1500 for a base price of INR 75000. Similarly, the customers would need to cough up INR 2000 extra on a purchase of INR 1 Lacs.

If you have any questions, please write your query in the comments section.

Also check out – How to order customized Initials Cufflinks in Gold?

Here’s How Much Extra You Will Pay on Gold Jewellery Post GST by Sourav

2 Comments

Burhan · July 14, 2017 at 8:41 pm

Rate of Gst on gold today

Sourav · July 15, 2017 at 12:34 pm

Hi Burhan, the rate of GST is always 3%. Let us give you a working example. Let’s suppose the gold price today is Rs.30000 for 10 grams gold. If you purchase 5 grams of 18K plain gold jewellery, and let’s assume that the jeweller is charging you zero making charges, then your costing for the jewellery would be as follows ==

5 grams x 0.75 x Rs.3000 = Rs.11250

Now GST will be calculated as 3% on this value. Therefore, the net tax you will be paying on this will be=

Rs.11250 x 0.03 = Rs.337.50